Home 〉 Our Impact

Towards a sustainable future - Making finance work for Africa's future.

Kenya

- Volume of funding £65M

- Number of FSD Africa-supported transactions closed: 2

Rwanda

- Volume of funding £2.50M

Tanzania

- Volume of funding £26.30M

- Number of FSD Africa-supported transactions closed: 1

Nigeria

- Volume of funding £18.68M

- Number of FSD Africa-supported transactions closed: 2

Mauritius

- Volume of funding £8.90M

Morocco

- Volume of funding £16.30M

- Number of FSD Africa-supported transactions closed: 1

Tanzania

- TECA - Lake Victoria’s aquaculture projects bring hope to fishing communities

- Gender bonds impact on SME finance: Mkajungu Hardware's Expansion Journey with Jasiri Loans

- Gender bonds impact on SME finance: Maggy Dress-Up's Business Growth with Jasiri Loans

- Gender bonds impact on SME finance: Feminine Hygiene Product Importers Grow with Jasiri Loans

Kenya

- Backing smaller innovative local firms in off-grid solar with affordable capital is part of the answer to Africa’s renewable energy

- KaroPay: ‘BimaLab accelerator refined our start-up idea’

- De-risking Geothermal Energy Investment in East Africa

- How BimaLab shaped MotiSure’s bodaboda riders’ insurance product

Nigeria

- Raising Investment Capital for Greenfield Infrastructure Projects with InfraCredit

- Trash to Resilience: How BimaLab boosted Soso Care’s unique microinsurance intervention

- Backing smaller innovative local firms in off-grid solar with affordable capital is part of the answer to Africa’s renewable energy

- “Green Bonds: A Vital Solution to Alleviate Nigeria’s Energy Crisis

Explore FSD Africa’s footprint and achievements

across the continent

Our Theory of Change

Financing a Sustainable Future

We believe that the financial sector plays a crucial role in tackling real sector challenges such as poverty, climate change and biodiversity loss. Financial Service Providers in Africa’s are slowly recognizing the need for integrating social and environmental aspects into their business models. We are collaborating with partners and using a variety of techniques to address key challenges and other financial sector issues hampering innovation in financial products and services. We investigate many pathways to attaining sustainable financial sector development impacting environment and African economies.

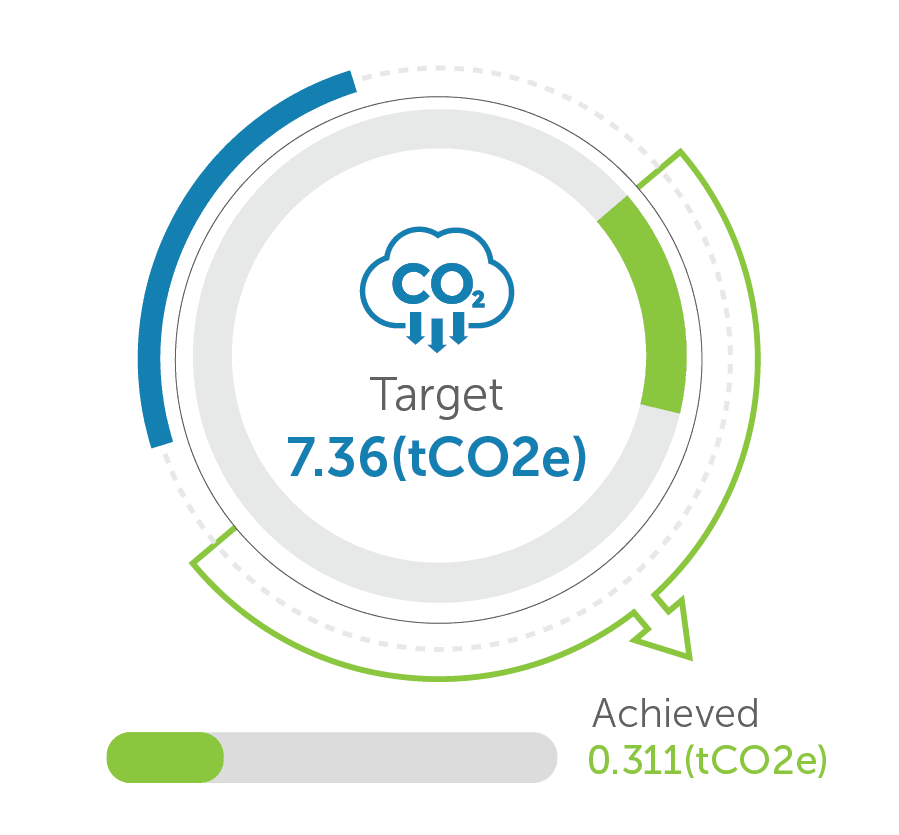

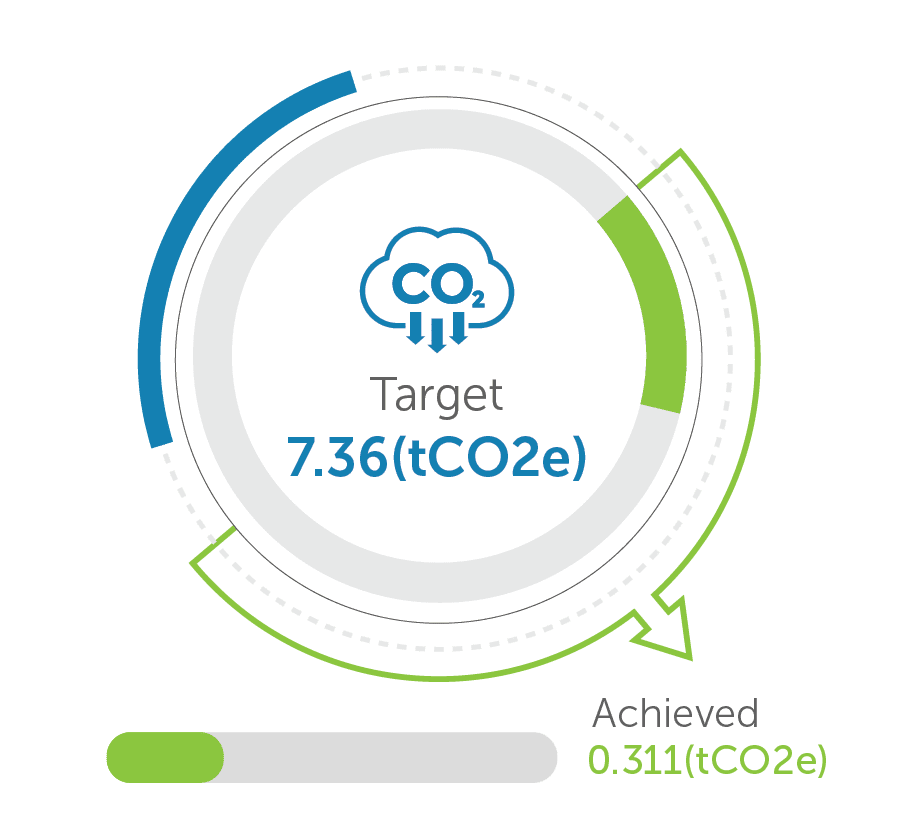

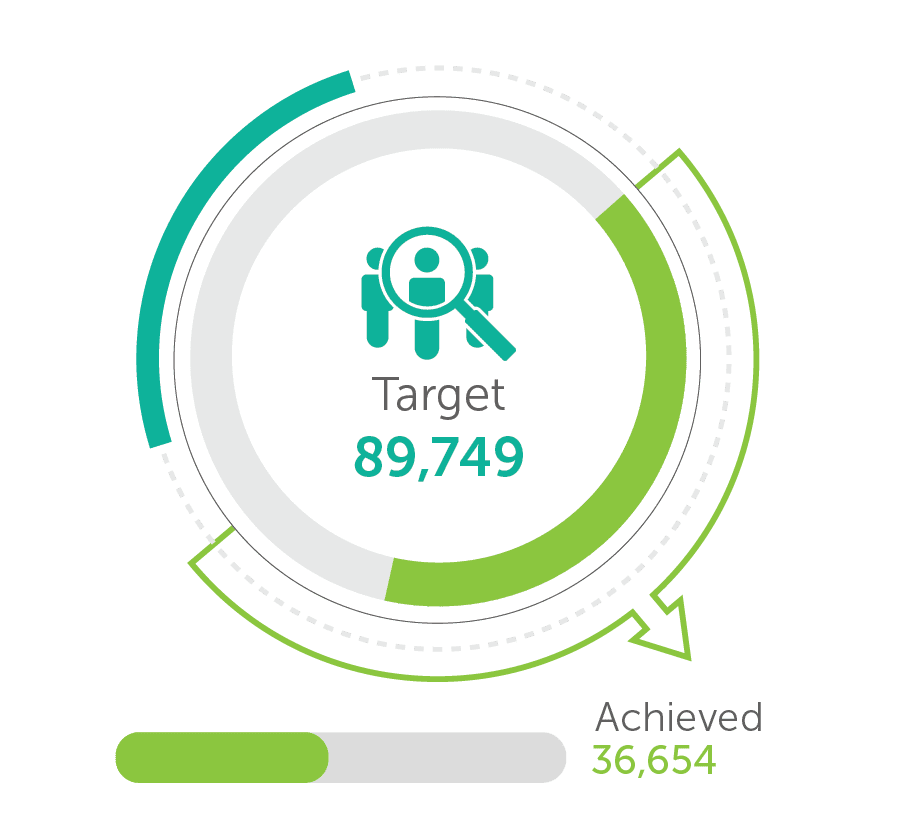

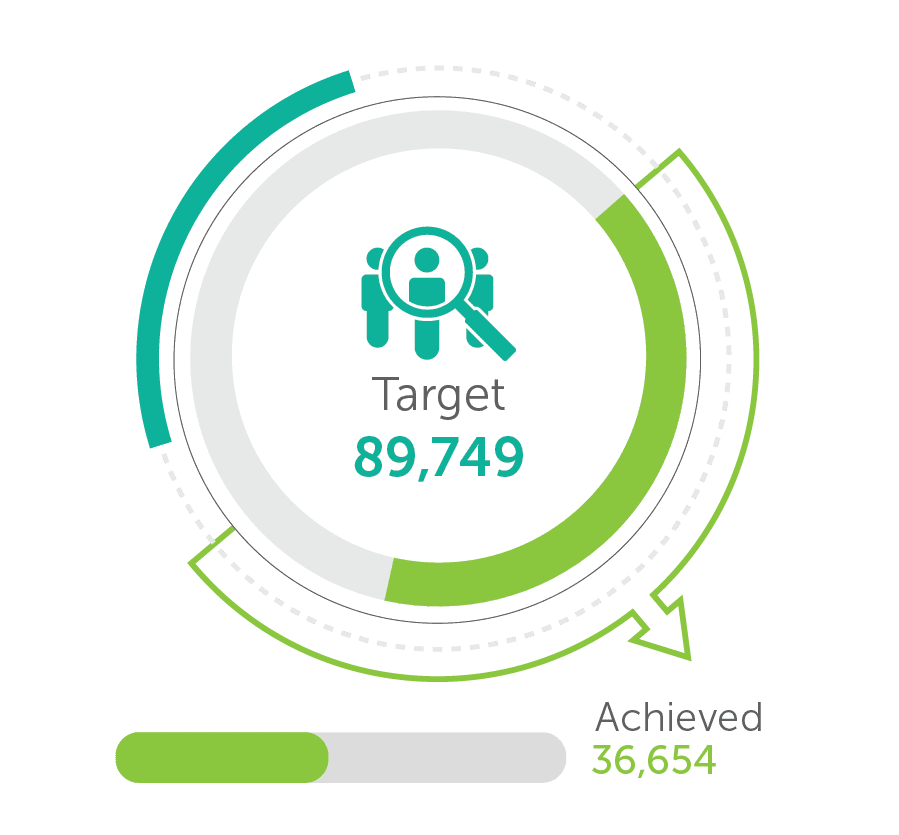

Targeted results between April 2021 and March 2026

0.311(tCO2e)

Net change in greenhouse gas emissions (tCO2e) – tonnes of GHG emissions reduced or avoided as a result of FSD Africa initiatives (million metric tCO2e)- ICF indicator

36,654

Number of jobs created, protected and supported through FSD Africa initiatives.

141,792

Number of people with improved access to basic services

£ 285m

Amount (£m) of finance mobilised/catalysed by FSD Africa from the public and private sector for projects designed to address the needs of low income and marginalized groups and women, and climate change purposes (ICF indicator)

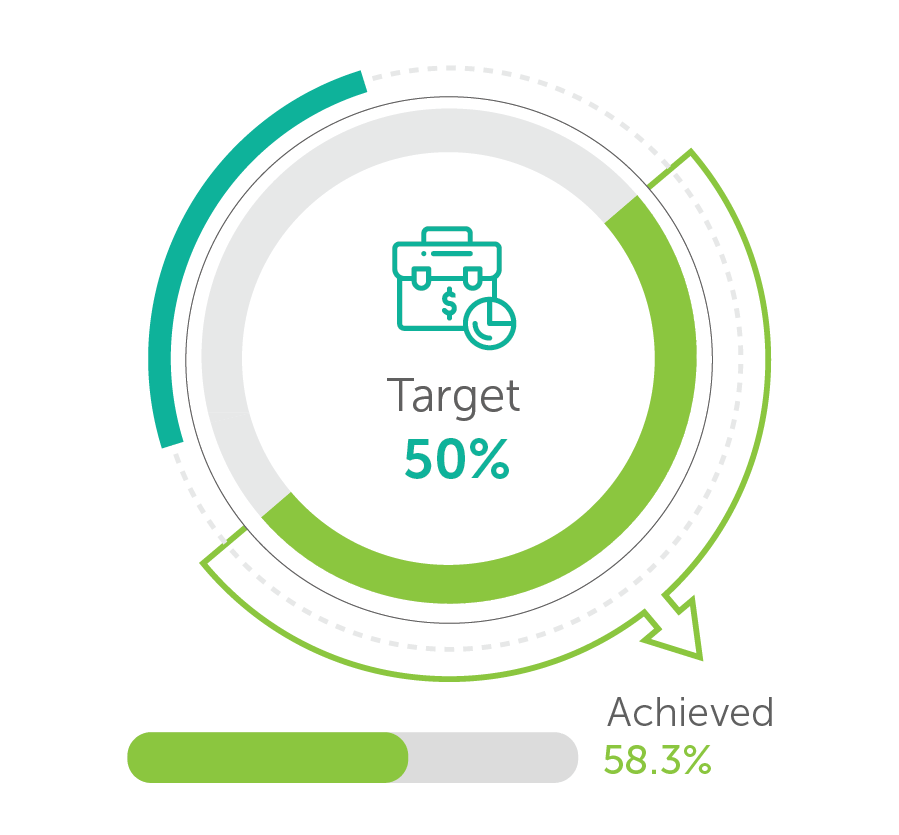

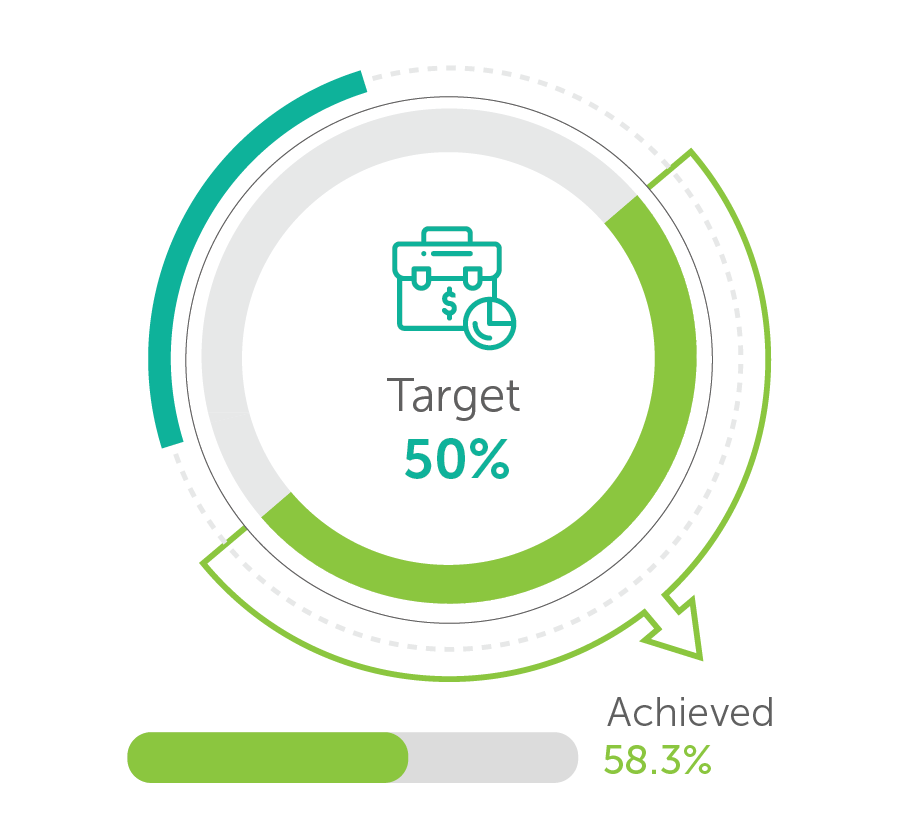

58.3%

Proportion of FSD Africa supported portfolio, and completed transactions that are financed in local currency

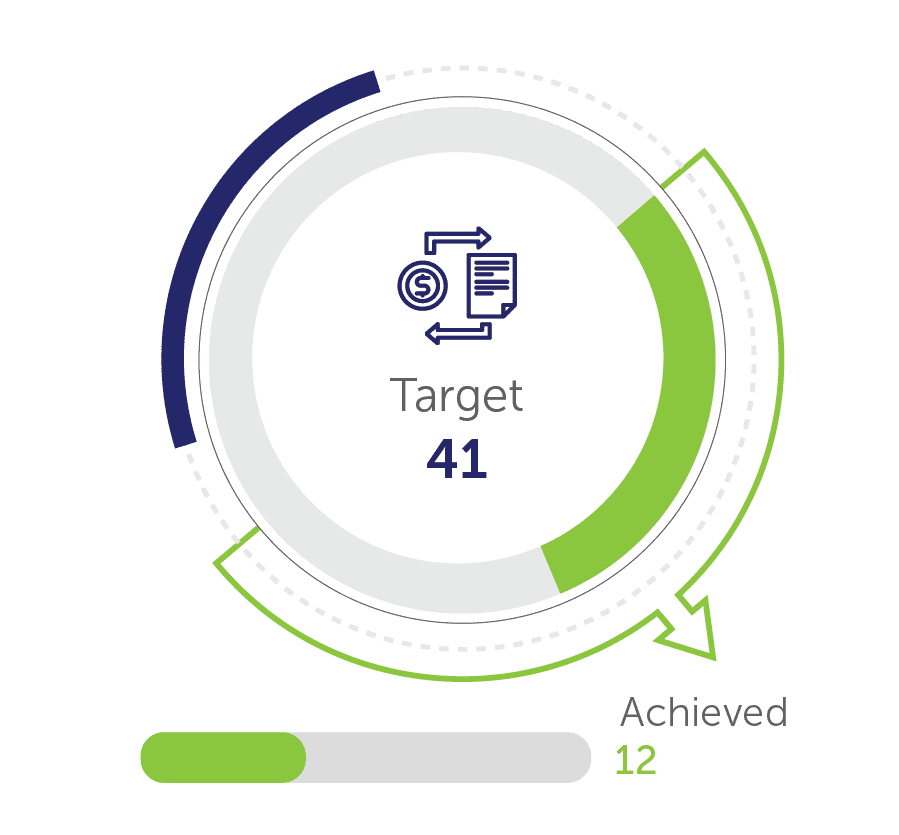

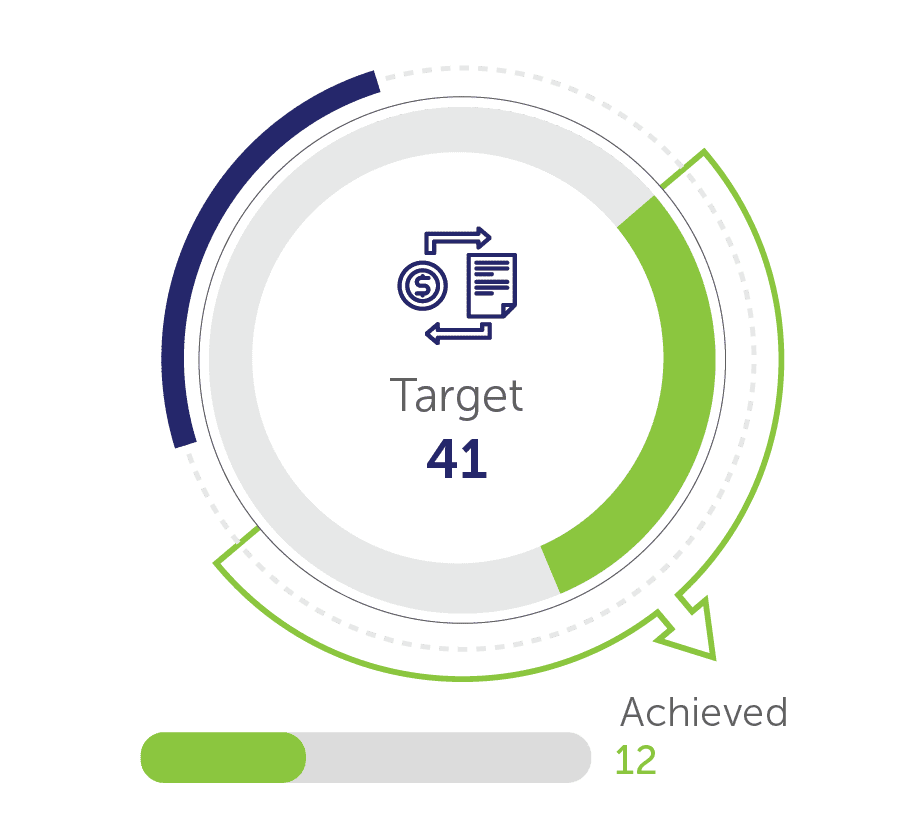

12

Number of FSD Africa supported transactions that have been closed

Voices From The Field

Publications

Team

Director, Development Impact

Senior Manager, Development Impact

Senior Specialist, Gender

Manager, Development Impact

Manager, Development Impact

Manager, Evidence and Insights

Assistant Manager, Development Impact

Analyst, Development Impact

Programme Assistant, Developmental Impact