Home 〉 Our Impact 〉 Supporting jobs by strengthening financial systems

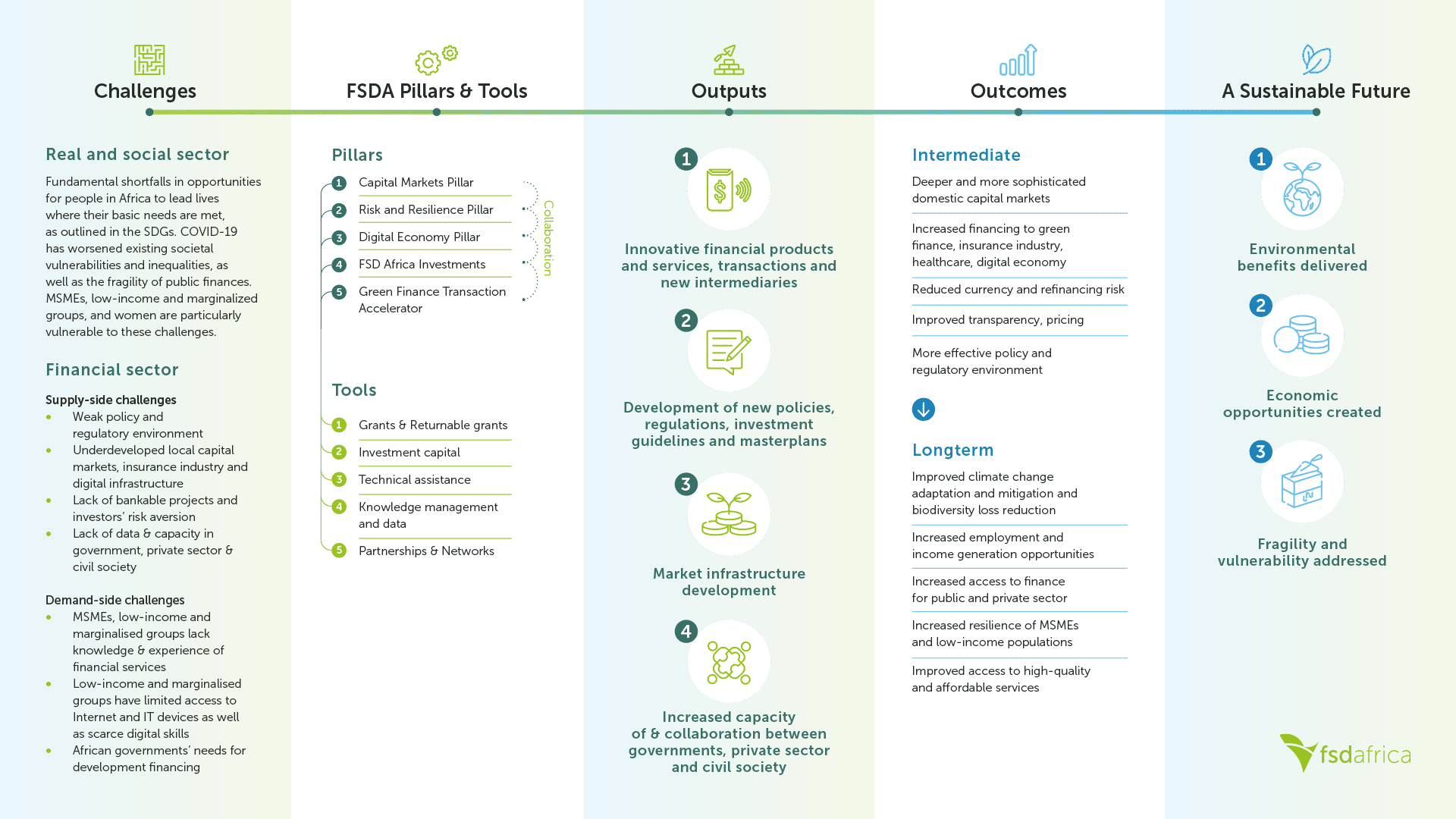

Our Theory of Change

Financing a Sustainable Future

We believe that the financial sector plays a crucial role in tackling real sector challenges such as poverty, climate change and biodiversity loss. Financial Service Providers in Africa’s are slowly recognising the need for integrating social and environmental aspects into their business models. This is challenged by some factors:

- Weak policy and regulatory environment, especially for green finance, the digital economy and the insurance market, compound already existing challenges in attracting long term finance.

- Underdeveloped financial sector due to the small size of the domestic economies, and business environment, quality of institutions and financial infrastructures. Additionally, the insurance industry doesn’t serve the needs of the majority of Africa’s population.

- A lack of technical and operational competence in the public, commercial, and civil society sectors on crucial issues including green finance, risk management, and prevention. This has hampered innovation in financial products and services.

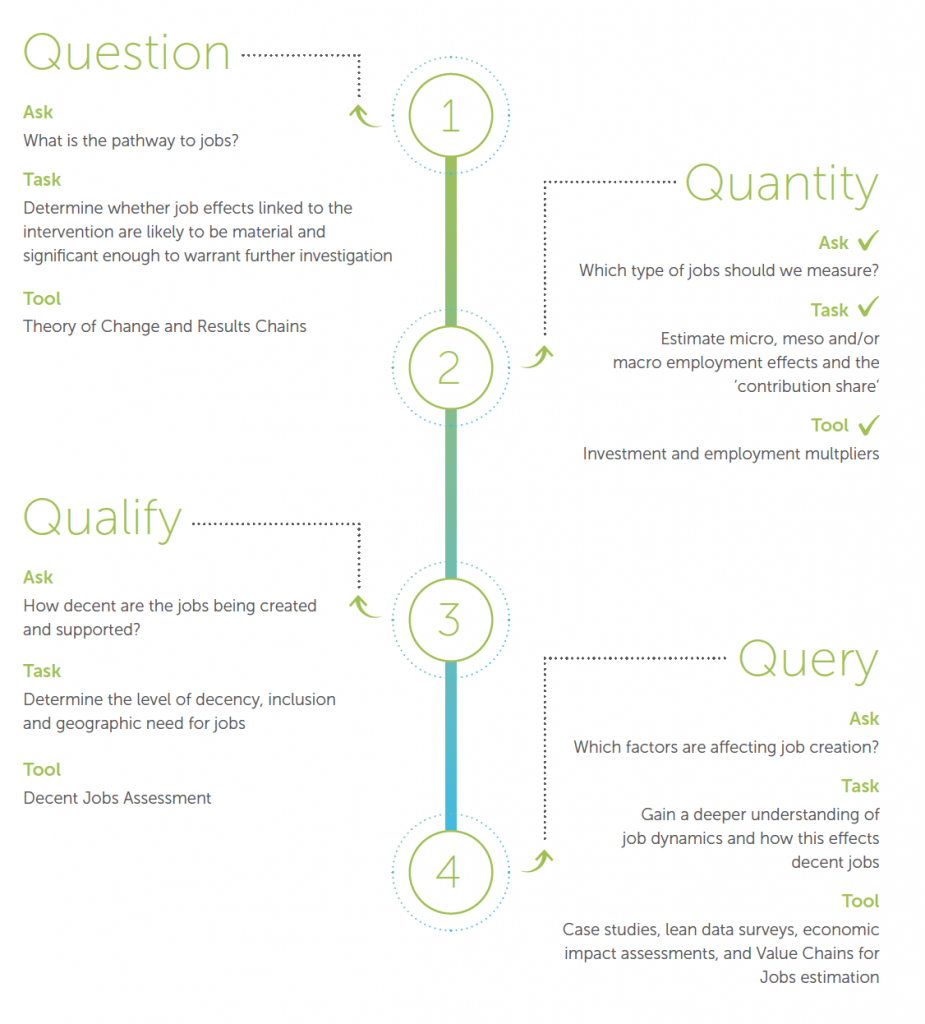

We are collaborating with partners and using a variety of techniques to address these and other financial sector issues. We investigate many pathways to attaining sustainable financial sector development impacting environment and African economies. Below we highlight a few pathways:

Vital to achieving our strategy are both financial and non-financial tools:

Grants and returnable grants: We provide grants without expectation for a financial return. This generally occurs when a business venture has significant potential but high risk. In some instances, we give grants to non-commercial projects with the potential for system-wide impact.

Investment capital: We finance high-risk businesses and funds operating in the financial sector that have the potential for high impact in financing green initiatives. We are distinct from other investors in that we understand that the dynamism of the financial sector necessitates flexibility and the utilization of a variety of transaction structures, including loans, guarantees, and equity or quasi-equity.

Technical assistance: We have a proven track record of providing advisory services and technical support to the public and private sectors. We collaborate with financial sector experts to convey knowledge and abilities that foster innovative thinking. We also collaborate with partners to co-design technical assistance initiatives and capacity-building support programs in an effort to increase ownership.

Data and knowledge management: FSD Africa invests in research, analysis, and intelligence-gathering initiatives that give financial sector stakeholders access to market data and knowledge. This enables their decisions in investment opportunities and effective risk management.

Networks and partnerships: we have as a wide and growing network of national, regional, and international stakeholders to crowdfund, pool ideas, share risk while expanding reach, and build sustainability. We take advantage of our connections with the UK’s Foreign, Commonwealth & Development Office to direct UK finance industry knowledge and funding into Africa.

We are collaborating closely with decision-makers to create policies that support green capital flows, equitable economic digitalisation, and the expansion of the insurance sector. This will improve underserved groups’ access to financing and help them become more resilient while preserving the environment.

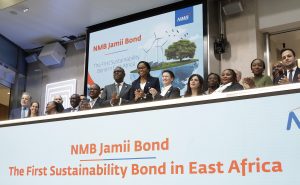

- We are investing in novel financial products, services, transactions, and intermediaries to direct more capital toward the green and real economies. Our support to development of carbon markets, which are relatively new market intermediary for green capital mobilisation, is one example.

- As we employ capital to reduce the risk associated with creative investments, we anticipate that successful transactions and intermediary models will act as a demonstration, encouraging additional participants to enter the market and adopt comparable transaction models. With a broader and more diverse investor base, we expect better funding opportunities for SMEs, particularly those working on sustainable solutions.