Women in Tanzania face a range of challenges in their participation in significant economic activities, as well as in their homes and communities. While not all these obstacles directly affect women’s inability to benefit from financial services, they all contribute significantly to the problem of women not making the most of their skills and opportunities. If these barriers are eliminated, more women can engage in economic activities and, consequently, the financial sector.

In January 2023, I had the opportunity to visit Tanzania to observe first-hand the groundbreaking impact of the Jasiri Gender Bond – an initiative by NMB Bank backed by FSD Africa. The purpose of the trip was to document the tangible outcomes of projects we support across sub-Saharan Africa as part of our “Voices from the Field” series. FSD Africa is dedicated to mobilising finance that not only drives economic and social development but also ensures environmental sustainability and resilience across the continent.

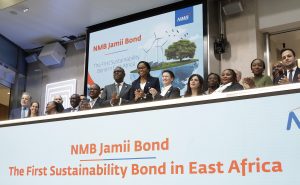

The Jasiri Gender Bond – the first gender bond in sub-Saharan Africa – was launched in April 2022 to address the significant financing gap faced by women-owned and led businesses. Named “Jasiri” – Swahili for “brave” – this bond represents the strength and determination of Tanzanian women entrepreneurs and is aimed at supporting their empowerment in line with the SDGs, particularly 1 (No Poverty), 5 (Gender Equality), and 10 (Reduced Inequalities).

Listed on the Dar Es Salaam Stock Exchange and the Luxembourg Green Exchange, the Jasiri Gender Bond raised approximately US$ 32 million, far exceeding expectations with a 197% oversubscription. This overwhelming response emphasises the bond’s significance as an inspiration for gender-focused economic empowerment in Africa.

A gender bond is a financial instrument that channels its proceeds into empowering women-led ventures. The Jasiri Gender Bond targets businesses that are either predominantly owned by women (at least 50%), have a workforce of more women than men, or offer products or services that significantly benefit women. Male-owned enterprises that notably support women’s needs also qualify as target enterprises. This could encompass a range of businesses, from maternity hospitals to companies specialising in feminine products, emphasising their pivotal role in uplifting women’s economic status.

As part of NMB Bank’s retail products, the Jasiri Bond provides women business owners with access to new markets, going beyond only financial assistance. The project does more than just give these women access to loans with rates lower than the industry average; it also gives them experience in foreign markets in countries like Turkey and China, which helps them become more savvy businesswomen. In addition to providing financial support, the bond cultivates a community of strong businesswomen by connecting them with a varied network of entrepreneurs across the continent.

By providing lower interest loans and educational support, this initiative empowers women, fostering significant personal and business growth, and contributing to the local economy’s dynamism. At the Sinza Business Center, one of the bank’s branches, Istoria Senda, the Business Manager spoke of the bond’s role in overcoming economic barriers for women.

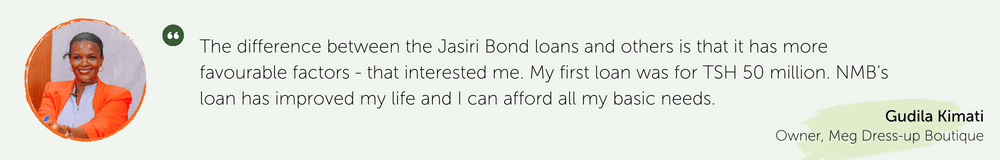

Gudila Kimati is the owner of a lucrative boutique, Maggy Dress-Up. She leveraged a loan obtained through the Jasiri Bond to expand her business, specialising in plus-size women’s clothing. This expansion not only grew her business but also improved her personal life, embodying the bond’s goal to enhance women’s economic opportunities.

We also met Mrs. Selina Godfrey Letara, a businesswoman with humble beginnings. Her entrepreneurial journey, from selling second-hand clothes to establishing a successful sanitary products business, showcases the broad impact of the Jasiri Bond. Her story highlights the importance of financial discipline and the role of strategic banking partnerships in women’s economic empowerment.

The Jasiri Gender Bond is more than a financial tool, it’s a catalyst for change, driving economic empowerment for women in Tanzania and setting a precedent for the African continent. By providing over 3,000 loans to women-led MSMEs, the bond has not only facilitated access to finance but also encouraged women’s entry into male-dominated industries, enhanced productivity, and catalysed local economic growth.

Long before Jasiri, the bank was already a champion for women, with a portfolio boasting nearly $500 million in loans to female entrepreneurs. The gender bond initiative didn’t just amplify their commitment; it also spotlighted their dedication to this vital market segment.

These stories from our impact series fall in line with our broader mission to tackle financial exclusion and foster sustainable, inclusive economic growth. Looking ahead, the bank is eager to work with governments, channelling sustainable finance into pivotal projects to secure necessary funding. Moreover, they’re setting their sights on greening their portfolio, aiming for at least 5% investments that align with their National Determined Contribution (NDC) goals by 2030, underlining their forward-thinking approach to both gender equality and environmental sustainability.

Watch the feature story below.